Church of England says unlikely to quit fossil fuel investment

LONDON (Reuters) - The Church of England pushed back on Friday from calls to get rid of its investments in companies extracting or selling fossil fuels, saying it would mean a financial hit and it was better to use shareholder influence to pressure change.

The church's Ethical Investment Advisory Group (EIAG) is reviewing its policy on ethical investment related to climate change, with some church officials calling for disinvestment from such companies to highlight the need to move to a low-carbon economy.

The Church of England, mother church of the world's 80 million people in the Anglican Communion, holds total investments worth about 8 billion pounds ($13 billion) that are used to pay clergy pensions and fund the church's work.

Some is invested in funds but the church also has direct investments of more than 10 million pounds in Shell, BP , Rio Tinto and BHP Billiton.

The diocese of Southwark last July passed a resolution for the church to completely divest from fossil fuels, following the lead of other religious organisations globally including Anglican dioceses in New Zealand and the Quakers in the UK.

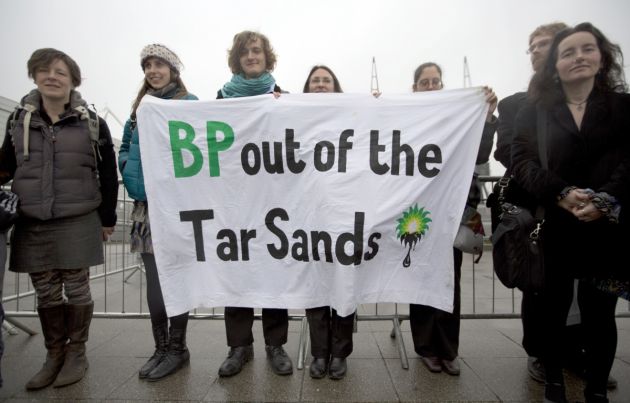

However, some in the church argue that shareholders should engage with companies to make them reorder their priorities and cut emissions. Others recommend quitting high-emission practices like coal and tar-sands with a proposed time-frame to move to a low-carbon portfolio.

Richard Burridge, deputy chairman of the EIAG that advises the church's three National Investing Bodies (NIBs) and a Church of England clergyman, said there was a real financial risk in excluding sectors of the market from investment for ethical reasons as it reduced opportunities.

He said 12.5 percent of the UK's FTSE350 stock market index was already excluded from investment as a result of ethical investment policies which had meant a loss of about 0.7 percent a year between 2001 and 2012.

A further 14.25 percent of the FTSE350 would be excluded if the church quit the "integrated oil and gas" and "oil and gas exploration and production" sectors, he said.

"This would leave 26.5 percent of the index excluded from investment, and a higher risk of financial detriment," Burridge said in a paper to be presented at the next meeting of the church's governing body, the General Synod, in February.

"From discussions to date, a recommendation that the NIBs should disinvest from all fossil fuel companies seems unlikely."

WORKING GROUP

The push for disinvestment follows the release of several reports by the church and other religious groups raising concerns about climate change. The Southwark resolution stemmed from a motion by a parishioner challenging the church's investment in Shell and the fossil fuel industry.

Burridge said the EIAG would consider the merits of blocking investment in some companies involved in fossil fuels.

"For example, the EIAG will consider whether to recommend that the NIBs should implement, at this stage of the transition to a low-carbon economy, ethical restrictions on investment in companies whose main business is coal mining," he said.

Jacqui Philips, clerk to the synod, said the review into the church's investment position was ongoing and the synod would be asked to set up a working group on the environment to look at initiatives to reduce the threat and impact of climate change.

"No decision has yet been made and this is something that is under review," Philips told Reuters.